You hear the phrase “pay yourself first” all the time. I agree in theory, but when we look at it deeper, how does that affect other areas of your financial life? Is the “pay yourself first” mentality really the best way to make progress with your money?

“Pay yourself first” is a frequently used phrase to just say, “Hey, you work hard for your money. Don’t let it get snatched up with frivolous and unnecessary expenses!” I agree, but I am here to challenge the thought process because I don’t think it takes into consideration one major factor — debt.

“Pay yourself first” is just another way to encourage saving. Saving for an emergency, saving for retirement, saving for a house or maybe a vacation.

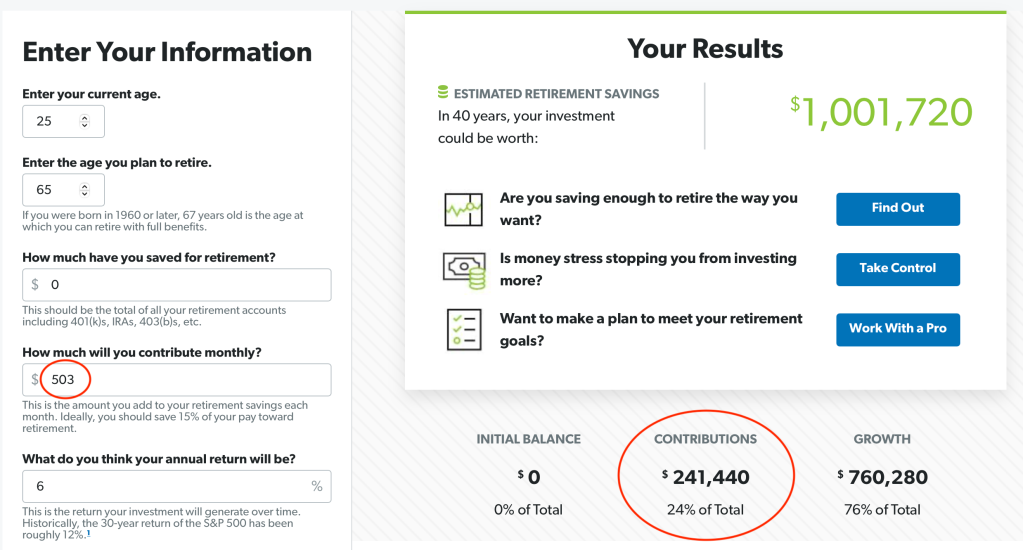

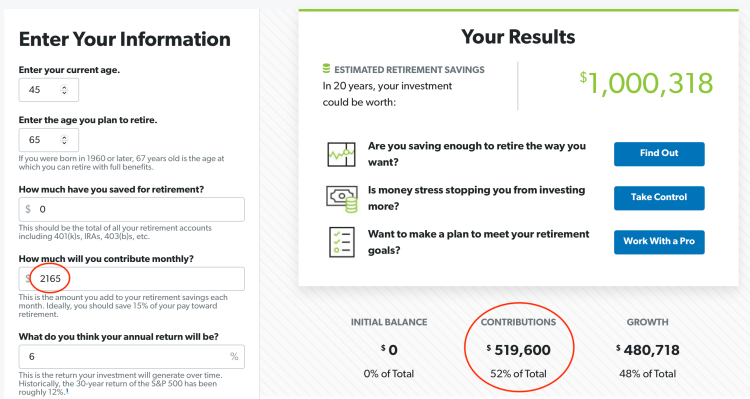

Saving and investing are absolutely important! But I want you to think about why the “pay yourself first” movement resonates with you. Is it because you want to be able to handle an emergency? Are you afraid you won’t have enough money for retirement? Are you trying to ensure you don’t miss out on the magic of compound interest?

Consider this possibility

Paying off debt is a form of paying yourself first.

Compounded interest is great for sure, but only when you have it working for you. In the case of most debt, compound interest is working just as much against you as your investments are working for you.

Let me prove it with an example. In this, we’ll use the tool of net worth to explain. Boiled down, pay yourself first is essentially a strategy to increase net worth by taking advantage of compound interest combined with time. So we’re able to use net worth to create a quantifiable means of determining which situation is best in our example.

Net worth is what you own minus what you owe so the highest net worth in our example wins.

As one caveat, I understand this isn’t a perfect example by any means. It cuts out a ton of life variables that could affect it. This is merely a way to prove a mathematical point about pay yourself first.

Here’s an example

Let’s make this super simple and say you have $10,000 invested at a 5% rate of return. You also have $10,000 in credit card debt, also at 5% interest rate. In this case, your net worth is $0 because you have $10,000 in investments and $10,000 in debts.

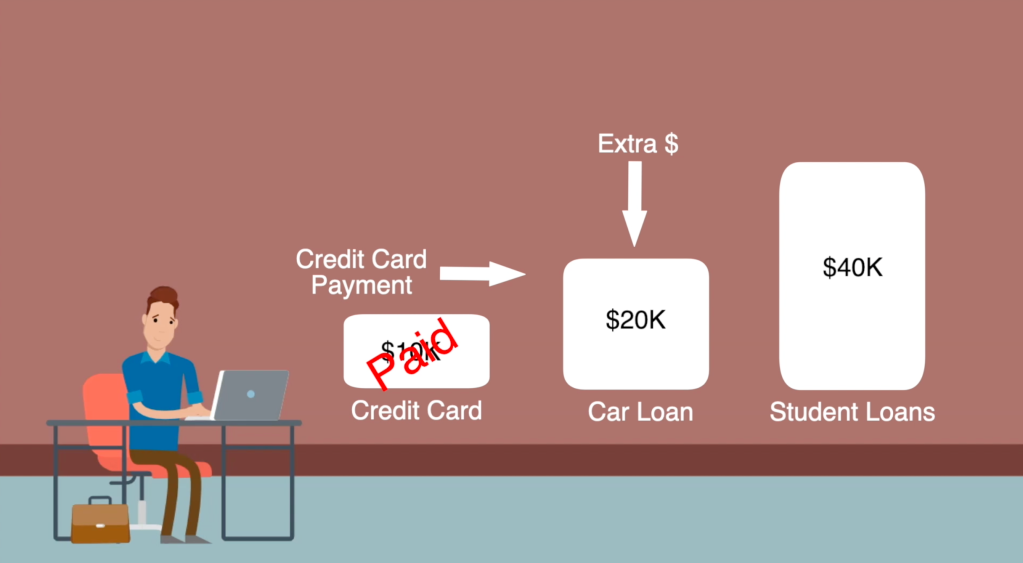

Situation 1: Extra money to investments

If you had $1000 of extra money per year to put anywhere, “pay yourself first” would say, “Let’s throw it at the investments. Let’s take advantage of that compound interest!”

If you did this but neglected the growing debt, ultimately in 5 years, your net worth would grow by $5525. Your investments would be at $18,288 and your credit card debt would be at $12,763.

Situation 2: Extra money to debts

Now, on the other hand, if you took that $1000 and put it towards paying down the debt while neglecting to contribute more to your investments, your net worth would STILL grow by $5525. After these same 5 years, your investments would be $12,763 and your credit card debt would be $7238.

Which one wins?

In both examples, net worth is the same. However, in the second example, the risk is lower. Whenever your debt is lower, your risk is inherently lower.

Now, keep in mind, this example shows has an interest rate of 5% for both investments and credit card interest. This example would change significantly depending on the type of investments and debt you use within it. The average interest rate for credit cards in America is much closer to 15% whereas the federal student loan interest rate is about 2.75%. Clearly this wasn’t meant to be a perfect example. But it was meant to challenge the reasoning behind the “pay yourself first” mentality.

Paying off debt is a guaranteed rate of return

Here’s one more thing. When you make an investment in the stock market, you are hoping to receive a good rate of return. The average rate of return in the stock market is about 10% according to Nerd Wallet. But, nothing is guaranteed in the stock market.

What is guaranteed is the interest rate on your loans.

As we’ve already established, paying down debt is the same as increasing net worth because you are diminishing the amount you owe on the loan. If your credit card interest rate is 15%, you are effectively guaranteeing a 15% rate of return on the money you use to pay it off. That’s a pretty good return!

Get the full picture

“Pay yourself first” is a great way to handle your money if you understand the full picture. Saving money, investing, AND paying off debt all fit. As a financial coach, I just really want you to get rid of that debt. It’ll increase your net worth and decrease your stress.

So let me pass this question onto you. How do you look at debt relative to the pay yourself first mentality?

I’d love to hear from you in the comments down below!

Like what you read (or watch)? Give the blog a follow in this little box below.

Get Financial Coaching

Are you overwhelmed by debt and feel like there’s no way out? Feeling intimidated by budgeting?

I can help! I’m a financial coach trained by Ramsey Solutions to guide people in their financial lives. Set up a free consultation below and I’ll listen to your situation and guide you on the right steps forward. There’s no commitment.